Why Early Termination Was the Only Winning Bet Left for PENN and ESPN?

The ESPN BET project has officially come to an end, with both parties (ESPN and PENN Entertainment) exercising the option for an early termination of their collaboration. Talk of this outcome had been growing louder for quite some time. What sealed the failure of a project that looked so promising on paper, and is the timing of the decision to bury ESPN BET merely a coincidence?

How Much Did PENN Lose on ESPN BET?

ESPN BET never managed to meet, or even get close to, the expectations placed upon it. The plans to achieve a 15-20% market share ultimately proved to be nothing more than a pipe dream. Despite a promising start and an 8% share shortly after launch, over time, instead of growing toward the set targets, the share dwindled to 3%, and later even less.

Despite the actions taken and subsequent integrations, the prospect of a rebound never materialized. This means that PENN Entertainment has failed for the second time to conquer the online sports betting sector, following its previous unsuccessful attempt with Barstool Sportsbook. Recall that PENN acquired Barstool for over half a billion dollars, only to soon sell it back to its founder, Dave Portnoy, for a symbolic dollar.

Under the agreement with ESPN, PENN paid the media giant $150 million annually and also provided ESPN with a warrant to purchase the company’s common stock. We know that in 2024, PENN allocated a total of $407 million to media expenses, of which $179 million went to Disney and $67.9 million was for the warrants. During the proxy battle that flared up this summer, activist investor HG Vora accused PENN of pouring $4 billion into the entire digital project, ultimately generating over a million dollars in losses.

Despite the discussion about the failed digital expansion, many noted that the success of ESPN BET was never a life-or-death matter for PENN Entertainment, and its failure does not spell disaster for the company. The possibility of an early termination of the partnership with ESPN had been discussed for several months, and over time, it began to seem an increasingly realistic and sensible option for both sides. It is relatively probable that ending the ESPN BET experiment and focusing on the core parts of the business will benefit both entities involved.

Why Is Closing Down ESPN BET a Good Decision?

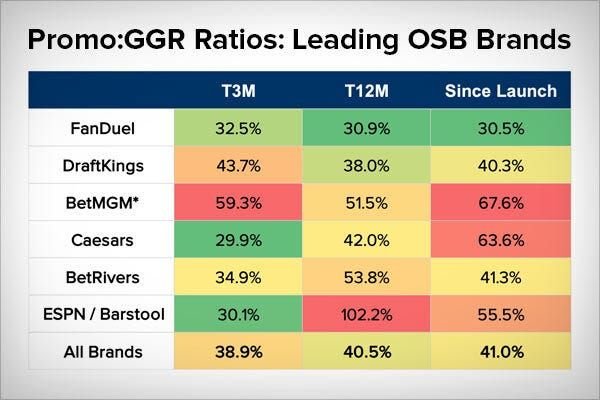

For PENN, ending the ESPN BET project is primarily about eliminating the high associated costs. Significant funds were invested in promotion to gain a foothold. ESPN BET had the second-highest rate of users using the app due to promotion (52%). The initial rapid growth in market share was the result of intense bonus offers, but this did not bring the expected long-term results. Every year, high hopes were pinned on the upcoming NFL season, when the PENN product was supposed to get closer to expectations. However, this inevitably involved further investments in an undertaking that was “Dead on Arrival” for many.

Source: EKG Line

Source: EKG Line

Analysts at Wells Fargo estimated that without ESPN BET, PENN’s digital business would generate $52 million in adjusted EBITDA in 2025, whereas it was actually bringing in $207 million in losses. The failure of Barstool was already a warning sign for PENN regarding involvement in online sports betting, and the course of the ESPN BET venture is now compelling evidence that it is time to focus on what PENN has already proven successful at and dedicate itself to increasing operational efficiency.

The success of theScore Bet in Canada and the good performance of Hollywood Casino in the U.S. further highlighted that while PENN can find its niche in the interactive space, ESPN BET was not necessarily the way to achieve it; in fact, it became a burden over time. Focusing on theScore BET and online casino could yield much better results than pouring money into a colossal failure built on a weak foundation. Especially since, despite ongoing issues with the effectiveness of the acquisition funnel, PENN managed to acquire a large pool of customers, creating potential for cross-selling activities into the online casino.

ESPN, in turn, is also freed from a burdensome agreement with no major future prospects and is quickly jumping into a new sportsbook partnership with DraftKings, a brand with an established position in the U.S. market. Ultimately, this is a relatively beneficial solution for all interested parties.

Unfavorable Climate

The decision to end ESPN BET was fast approaching, but its timing, even if largely coincidental, is quite telling. Operators and investors seem shaken by the position and growth rate of prediction markets. More entities are launching or planning to launch event contracts. Sweepstakes and DFS operators are deciding to migrate to this space, as if it were a safer haven for them. Trump Media & Technology Group is launching its own prediction platform, and Donald Trump Jr. is advising Kalshi and Polymarket. Pressure is also mounting on sports betting operators to take appropriate steps here.

The company that has made the most progress in this direction is DraftKings, which is soon set to launch DraftKings Predict, powered by the Railbird acquisition. FanDuel has also opened its path to prediction markets by entering a partnership with the CME Group. Where would ESPN BET fit into all of this? Did the exploding pressure to take steps in this area, and consequently undertake further investments, contribute to taking concrete steps regarding ESPN BET’s future?

CEO Jay Snowden never showed particular enthusiasm for prediction markets. “It’s obviously not priority one for us,” he said in May. “I wouldn’t expect us to be a first mover,” he emphasized in August. Finally, in November, he sharpened his tone, calling prediction markets a “major threat to the industry.” Waiting for ESPN BET’s situation to improve in the future, when DraftKings was about to actively build its brand among states without legal betting, led by Texas, would be madness.

The entire climate surrounding sports betting lately has not been conducive to positive outcomes for anyone involved. Betting scandals in the NBA, MLB, and NCAA, increasing regulatory pressure and potential tax hikes, unfavorable sports event outcomes, and tanking stock prices of companies involved in online sports betting. Even if potential was seen in further integrations and the upcoming NFL season last summer, by November 2025, the remaining belief in any success for the project must have evaporated.

Better Times Ahead?

Things will likely calm down a bit around PENN in the near future. The company has shed unnecessary ballast and intends to focus on the fundamentals. Despite the unfavorable market reaction, CEO Jay Snowden showed confidence in continued success by investing nearly half a million dollars in PENN stock.

Competition in the online sports betting market is currently very challenging. Aside from the impact of external factors, it must be clearly stated that we are dealing with a duopoly here that simply cannot be broken in the near future. The key to successful operation in the U.S. market seems to be finding one’s niche with limited costs, rather than trying to embody the myth of Sisyphus, hoping that despite devastating adversity, that cursed stone will eventually be rolled to the top.

Recommended