Brave New World: What We Know and Don’t Know About Prediction Markets at the Midpoint of 2025

Prediction markets have undoubtedly been one of the dominant themes of the first half of this year. From both a legal and product perspective, changes are happening at lightning speed, and the first significant moves in mergers and acquisitions (M&A) have recently taken place. Where do prediction markets stand today? Are they here to stay for good? How will operators respond? What will the second half of the year bring? To help answer these questions, at least in part, we spoke with James Kilsby, Vice President, Americas, and Chief Analyst at Vixio.

As July began, we entered the second half of 2025, a year that, from many angles, appears to be a turning point for the sports betting industry and the broader gambling sector, which, as it turns out, truly abhors inertia. A comfortable existence free from external disruptors is simply no longer an option. Time has shown emphatically that every open space, every gap, is just waiting to be filled by new companies with fresh ideas on how to navigate existing regulations. We’ve gathered the most significant events from the first half of the year related to prediction markets and attempted to draw conclusions for the future.

Major Changes at the CFTC

From the start of this year, a lot has been happening at the Commodity Futures Trading Commission (CFTC), the agency tasked with regulating the prediction markets space, at least according to the platforms themselves. Rostin Behnam stepped down as chair, and Acting Commissioner Caroline Pham took over. This was generally seen as a favorable shift for prediction market platforms, whose interactions with the CFTC had not been entirely smooth.

This marked a new chapter, with Kalshi, Robinhood, and Crypto.com seeing significant opportunities. Optimism was further fueled by Acting Commissioner Caroline Pham’s comments, which suggested a greater openness to innovative solutions. However, in the following months, things at the CFTC didn’t unfold particularly positively, even from an objective standpoint.

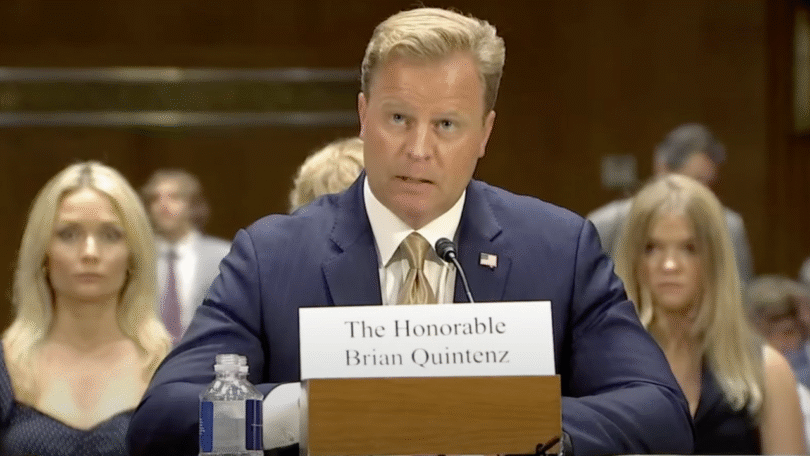

Brian Quintenz, nominated as the new commissioner, has yet to be confirmed by the Senate. Instead, he has faced numerous letters and official comments questioning his ability to effectively lead the CFTC, given his ongoing role on Kalshi’s board (he has promised to step down if confirmed).

Even before taking the helm at the CFTC, Quintenz may already sense the shadow of an impending crisis. Shortly after he officially assumes leadership, he could find himself as the sole commissioner due to a wave of departures and announced exits by other commissioners. The agency’s staff has also been shrinking, with over 20 employees cut in recent weeks. This comes amid existing commentary that, in its current staffing state, the CFTC is unable to effectively fulfill its duties, including overseeing the prediction markets space.

Meanwhile, the CFTC has been observing developments rather passively, a point criticized by tribes and various organizations directed at Acting Commissioner Caroline Pham. A roundtable planned for late April was unofficially canceled, even though many prospective participants had already booked flights to attend. From the perspective of defining the role and space for prediction markets, it’s hard to view the CFTC’s performance in the first half of this year positively. We know roughly as much, and can assume roughly as much, as we did six months ago.

What’s Next: The moment Brian Quintenz’s nomination is officially confirmed will be an absolutely pivotal event. This should happen any day now, though a Senate vote scheduled for Monday fell through for somewhat random reasons. Opposition to his candidacy, however, is not waning, it’s only growing. Based on Quintenz’s past statements, we can expect prediction market platforms to be granted considerable freedom. In its current state of staffing shortages, the CFTC not only has no intention but also lacks the capacity to stand in their way.

Kalshi Goes All In

Kalshi is undoubtedly the face of the recent upheaval surrounding prediction markets. From the very beginning to now (though this burden may soon be shared with Polymarket, more on that later), Kalshi has been on the front lines, clashing with states and tribes. Robinhood and Crypto.com stand nearby, lending support and occasionally appearing in legal filings, but ultimately, it all boils down to what Kalshi does, what its legal representatives say, and what Tarek Mansour says.

Since it became clear that Donald Trump would return to the White House, essentially since the explosion in popularity of prediction markets, Kalshi has stopped looking back. It’s aggressively expanding its sports event offerings, marketing itself as a company that legally allows betting in all 50 states. When a state challenges it, Kalshi heads straight to court. The company is far less cautious about what it says and does. In typical circumstances, one might say pride comes before a fall, but so far, there’s no clear sign of any setback for Kalshi. Kalshi and Tarek Mansour have grown significantly more confident, as the landscape has allowed them to.

In June, Kalshi announced the closing of a $185 million Series C funding round, valuing the company at $2 billion. Previous partnerships with Robinhood and Webull further highlight the scale of Kalshi’s operations.

Tarek Mansour is framing Kalshi as a David fighting Goliath, standing up to everyone seeking its downfall. This narrative was particularly striking in his latest interview, where he described Kalshi as waging a “brutal, bloody war” for “the right of prediction markets to exist.” He listed its opponents, saying: “Today, Kalshi is fighting: 100 tribes, 34 states, dozens of self-interested gambling advocacy groups, countless genius ‘LinkedIn lawyers,’ predatory private companies bringing claims based on 300-year-old British laws.” He concluded: “Our impact on sports speaks for itself: users are seeing drastically better results on Kalshi than on traditional sportsbooks.”

What’s Next: Kalshi is undeniably in a privileged position in the U.S. and is capitalizing on being the face of this entire saga. Product limitations, as pointed out by sports betting operators, could be a challenge, but rumors of potential parlays are growing louder, and many believe this could be an absolute game-changer for Kalshi. Another potential issue is Kalshi’s reliance on sports events and the offseason lull in summer. According to data regularly published by Dustin Gouker of The Event Horizon, over 80% of Kalshi’s volume consistently comes from sports events. Overcoming these limitations could propel Kalshi and the entire prediction markets space to a whole new level.

Will Kalshi overcome these challenges and reach a level that genuinely threatens traditional sports betting operators, or is the real prize the states without legal sports betting? “In states that offer sports betting, it probably will remain a niche, based on trends of exchange wagering in other jurisdictions. Sports betting companies still have a massive advantage in terms of existing customer databases, marketing dollars, and the advanced types of parlays they can offer,” argues James Kilsby.

“Kalshi can offer wagering on a wider variety of markets outside the traditional sports world, but many of those are much lower volume than seen in a normal sports betting portfolio. In states that don’t have sports betting, which includes major markets like California and Texas, however, prediction markets can really gain a foothold and a first-mover advantage to the point that they could remain competitive even if sports betting is legalized in the coming years,” he adds.

Threats from States and Tribes

There’s another factor that has the greatest chance of shaping the future of Kalshi and prediction markets: ongoing lawsuits in three states and actions taken against prediction markets in others. The first wave of cease-and-desist letters began in Nevada, followed by states like New Jersey and Maryland. In these three states, Kalshi opted to seek preliminary injunctions in court, launching a legal battle to continue offering its services to residents unchanged.

While this didn’t entirely halt further cease-and-desist orders, it certainly slowed them down. Kalshi could also celebrate early victories in Nevada and New Jersey, where courts granted preliminary injunctions. The first hurdles emerged in Maryland, where Judge Adam Abelson expressed skepticism toward Kalshi’s arguments, accusing the company of inconsistency. He posed several tough questions that Kalshi struggled to answer convincingly. Nevertheless, Maryland also temporarily stayed its cease-and-desist order, allowing Kalshi to continue operations there.

Another significant development was the industry’s unified stand against Kalshi, marked by a flood of amicus briefs filed in the New Jersey appeal. A coalition of 60 Native American tribes and nine tribal organizations, including the Indian Gaming Association (IGA), highlighted the threat to tribal sovereignty and the Indian Gaming Regulatory Act (IGRA).

Similar briefs were filed in the Maryland case. Additionally, in July, three California tribes filed a 71-page lawsuit against Kalshi, accusing the company of operating illegal, unregulated sports betting and violating IGRA and their tribal agreements.

What’s Next: Ultimately, Kalshi is fighting legal battles on multiple fronts, facing opposition from hundreds of organizations. The real threat to prediction markets lies here, rather than in the CFTC’s actions. Kalshi has taken some significant hits recently, which may have dented the company’s confidence after a string of successes. While the outcomes of these lawsuits are hard to predict, the industry’s continued unification against the threat of prediction markets is something we’d confidently buy a “Yes” contract on.

“It’s certainly possible that at some point, a federal judge or panel of judges somewhere will rule against Kalshi, but in lieu of that, federal regulators have shown no inclination to intervene to slow their growth, and without someone stepping in to halt the progress, exchanges like Kalshi and others will likely continue to operate and push as far as they can,” James Kilsby, Vice President, Americas, and Chief Analyst at Vixio, told us.

Polymarket Returns to the U.S.

This is one of those comebacks that, over time, we could increasingly see coming. The world’s largest international prediction market platform is returning to the U.S. after withdrawing from North America following a 2022 settlement with the CFTC. Polymarket finalized the acquisition of the holding company of a CFTC-licensed derivatives exchange (QCX, LLC) and clearinghouse (QC Clearing LLC), collectively known as QCEX, for $112 million. QCEX received CFTC approval just two weeks before the acquisition was announced.

Following its partnership with Elon Musk’s X, we could anticipate that, riding the wave of Kalshi’s actions and a favorable legislative environment, Polymarket would attempt a U.S. comeback, and it has. Kalshi appears here as the battering ram that broke open the door for Polymarket’s return, bringing back its most significant competitor.

We don’t yet know when Polymarket will actually launch in the U.S., but the company’s combative stance is impossible to overlook. CEO Shayne Coplan openly stated in a CNBC interview that Polymarket is the true pioneer, with other platforms merely imitating it. “Polymarket is Polymarket. And they’re a Polymarket copycat,” he said.

What’s Next: Polymarket’s return is, without a doubt, one of the most significant events in the prediction markets space this year. We’re talking about a company with the resources to compete with Kalshi, which, while dominant in the number of available markets, lags behind Polymarket in trading volume due to the latter’s international scale. The key will be the return date, expected to happen soon, though we all know how subjective “soon” can be.

Are Prediction Markets a Source of Truth About the World?

While prediction market platforms have increasingly adopted a bolder stance, aligning their messaging closer to traditional sports betting operators, they remain steadfast in promoting their image as a source of objective insight into global events. They persistently push the narrative that prediction markets enable more accurate forecasting of future events than traditional information sources, as real money is at stake. Below are just a few select quotes:

Vlad Tenev (CEO of Robinhood): “First of all, I think prediction markets are the future of not just trading, but also information. I’ve been a big believer in the power of prediction markets for a long time – kind of a student of them – and I think prediction markets should be live for everything.”

Shayne Coplan (CEO of Polymarket): “The next information age won’t be driven by the 20th century’s media monoliths – it’ll be driven by markets.”

Tarek Mansour (CEO of Kalshi): “Polls have been failing us. We don’t know who to listen to. If you go to CNN and Fox, you get two different stories.”

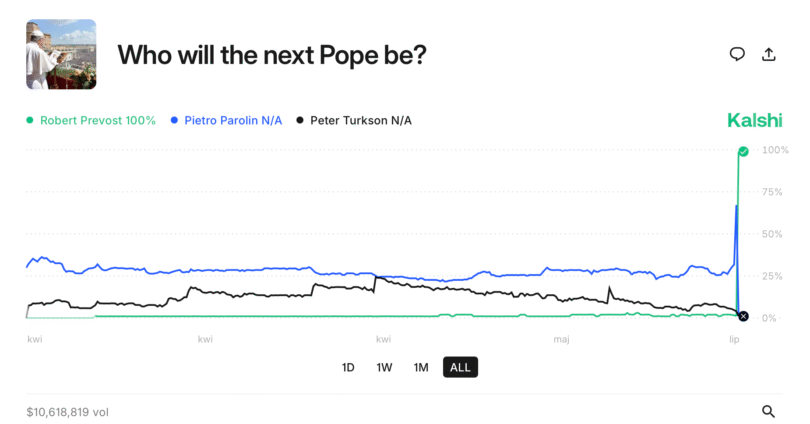

However, this narrative has been called into question multiple times. No matter how loudly or frequently prediction markets are touted as sources of truth, their list of missteps continues to grow. Notable errors include the outcomes of the Democratic primaries for New York City mayor, the selection of a new pope, and the viewership of the Oscars.

What’s Next: Anyone with even a basic understanding of how prediction markets work knows they are not infallible. Nevertheless, the erroneous favoritism of Andrew Cuomo in the Democratic primaries for New York City mayor sharply contradicts claims of being more accurate than polls. Even more problematic is the infamous Polymarket market on whether Ukrainian President Volodymyr Zelenskyy would wear a suit. The issue arises when a market’s outcome becomes ambiguous, leading to a point where we have two different truths and two different narratives, the very issue Tarek Mansour referenced when comparing CNN and Fox.

Is This the Moment for Operators to Enter Prediction Markets?

In the face of growing competition from prediction markets, it’s increasingly reasonable for sports betting operators to follow the adage “if you can’t beat them, join them” and expand their offerings to include prediction markets. Rumors of discussions between FanDuel and Kalshi or DraftKings and the CFTC-regulated Railbird Exchange shouldn’t come as a shock. Operators should, and likely are, considering entering the prediction markets space. The prospect of offering contracts on sports events in states without legal sports betting is particularly enticing.

What’s Next: The industry remains in observer mode, and everything will hinge on how Kalshi’s legal battles unfold. It seems only a matter of time before one operator presses the “Launch” button, and it could be mere days or even hours before their biggest competitor in the field follows suit.

“I think the answer is yes [whether sports betting operators will enter prediction markets], but only once operators have a level of certainty that prediction markets are indeed here to stay. The last thing a major operator wants to do is put the wheels in motion or spend a lot of money on an acquisition, only to receive an unfavorable court ruling that could suddenly put their state gaming licenses in peril if they’re found to have offered an unlawful form of gaming in a state. Another potential threat would be a change in administration at the federal government level, with one less inclined to support sports-event markets as a permitted prediction exchange,” says James Kilsby.

“The major benefits to a current sports betting operator would be the ability to offer a betting product in states like Florida, Texas, and California, where they’ve been shut out so far, but the product would be a more limited one, and potentially a less lucrative one than they offer anywhere else,” Kilsby emphasizes.

So What’s Next: Can Prediction Markets Coexist with Sports Betting Operators?

Platforms like Kalshi vividly demonstrate how quickly one can carve out a niche in a legally ambiguous space. For operators, this is a clear lesson that not only the legal market and offshore betting operators, what’s visible on the horizon, can pose a serious threat and competition.

On the other hand, prediction markets are still in a relatively early stage of development, and their ultimate success is far from set in stone. Prediction markets appear as a significant competitor to sports betting, but only in specific areas and geographic regions… at least for now.

“I don’t think you’ll see significant change unless prediction markets just absolutely explode in popularity beyond anything we’ve seen in international markets with exchange wagering, and it takes a significant chunk out of an operator’s business or a state’s tax revenue. Operators will push for lower or consistent tax rates and may also push for fewer restrictions on market types to allow them to offer some of the novelty markets that prediction markets can offer as a counter,” says James Kilsby.

It must also be acknowledged that Kalshi and the prediction market platforms following in its wake have, for a time, enjoyed near-ideal conditions for rapid growth. Positioning themselves in the perfect vacuum between federal and state regulatory authority has undoubtedly been key to their success.

“State regulators will likely continue to use as much authority as they can to police the prediction exchanges, but so far, courts have maintained that they have very little authority to do so. Ultimately, however, without federal legislative or judicial intervention, there’s very little that regulators can do to change their approach,” Kilsby adds.

There are still too many variables to definitively determine the position of prediction markets in the U.S. gambling landscape. For instance, Polymarket’s recent return to the U.S. significantly shifts the overall perception of the issue.

In a conversation with US iGaming Hub, James Kilsby from Vixio argues that peaceful coexistence between sports betting operators and prediction market platforms is a realistic possibility.

“Traditional sports betting platforms already coexist with exchange products in international jurisdictions, and in many cases, consumers are going to prefer the sports betting offering anyway, as it can offer markets on a lot of different sports and propositions within each game, with a more diverse parlay mix, among other features. Meanwhile, the exchange product could potentially offer more favorable odds and can offer wagering on events that state gaming regulators are more skeptical of, like elections. It also may be more appealing to someone who enjoys day trading, which has become more popular among the same demographics that sports betting companies frequently target (men in their 20s and 30s), thanks to apps like Robinhood,” he concludes.

There’s no doubt, however, that when it comes to defining the place of prediction markets, we’re still at a crossroads. From time to time, news emerges suggesting unfavorable outcomes for prediction market platforms, but these are typically quickly overshadowed by reports of new milestones and successes by Kalshi or Polymarket on the international stage. The past six months have been a wild ride for prediction markets, but the resolution of this story is still far from near.

Recommended