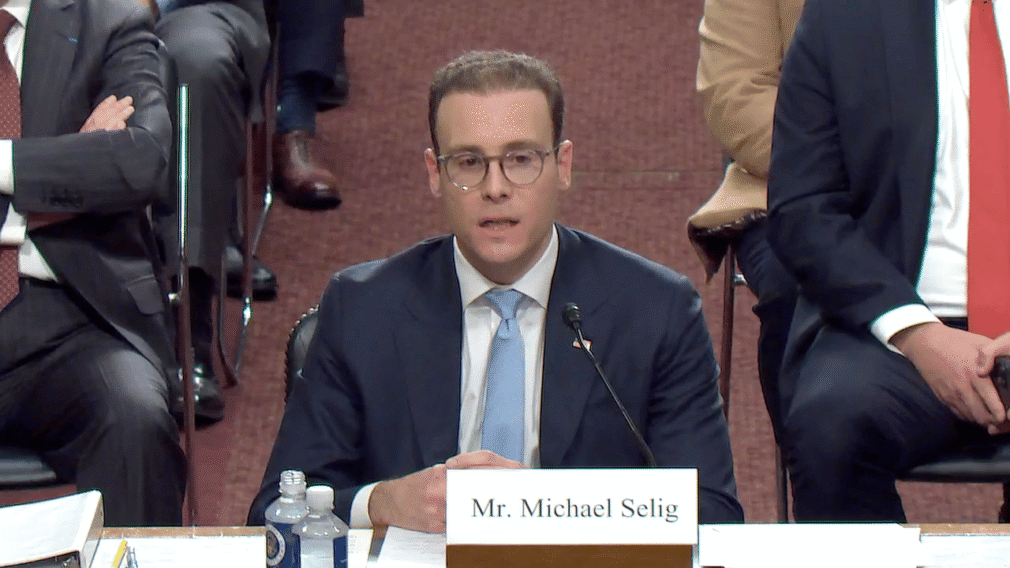

CFTC Nominee Sidesteps Questions on Prediction Markets During Senate Hearing

Donald Trump’s nominee for CFTC chair, Michael Selig, appeared before the Senate Committee on Agriculture, Nutrition, and Forestry on Wednesday. During the session, Senators pressed Selig to define the rules for event contracts. However, despite repeated questions, the nominee refused to state his personal position on whether these markets constitute illegal gambling.

President Donald Trump nominated Selig to lead the Commodity Futures Trading Commission (CFTC). The committee plans to vote on his confirmation this Thursday.

Deferring to the Referees

The central conflict of the hearing involved the definition of “gaming.” Platforms like Kalshi and Polymarket offer contracts that replicate sports betting mechanics. Under the Commodities Exchange Act of 1936, the CFTC has the authority to remove contracts that act against the public interest or involve gaming. Senators Tina Smith (D-MN) and Adam Schiff (D-Calif.) asked Selig if he views these products as games of chance.

Selig did not provide a direct answer. Instead, he treated the issue as a matter for the judicial system to resolve. He called the definition of gaming a “very challenging interpretive question.” When asked for his view, he stated that as a lawyer, his answer is always, “It depends.” He told the committee he intends to “look to the courts” for guidance rather than establishing a new interpretation himself.

The nominee promised to approach the job with a “blank slate” if confirmed. He argued that it would be “irresponsible” to prejudge the issue before reviewing specific cases or court opinions. This stance allows the current market mechanics to continue without immediate regulatory intervention from the Chair.

Senators also raised concerns regarding potential conflicts of interest. The Trump family holds business interests in the prediction market sector. Donald Trump Jr. currently serves as an advisor to Kalshi. Selig responded that he intends to “always adhere to the law” regarding ethics and decision-making.

New Rules for Digital Commodities

The committee also discussed expanding the CFTC’s rule set to cover cryptocurrency. Committee Chairman John Boozman (R-Ark.) argued that the CFTC is the correct agency to regulate digital commodities like Bitcoin and Ether. He stated the agency has the right expertise for this sector.

Selig supported the push for new legislation. He currently serves as chief counsel to the Crypto Team at the Securities and Exchange Commission (SEC). He argued that the US market needs “clear, simple guidelines” to keep developers from moving their businesses to other countries. He explicitly opposed “regulation by enforcement,” a practice where agencies punish companies for breaking rules that were never clearly written down.

He also spoke in favor of the physical infrastructure behind these digital assets. Selig described Bitcoin mining as “vitally important infrastructure” that should be built and maintained within the United States.

Agency Resources and Anti-Cheat Measures

The hearing shifted to the operational capacity of the CFTC. If confirmed, Selig would temporarily serve as the only commissioner on a board meant to have five members. Senators worried that a single-member commission might be vulnerable to external pressure.

When asked if the agency needs more funding to police these expanding markets, Selig did not commit to a request. He stated he would make that assessment only after taking office.

The discussion touched on preventing catastrophic failures, such as the collapse of the FTX exchange. Selig admitted that fraud and manipulation are “bounded by the ingenuity of man.” However, he promised to enforce the law strictly against bad actors.

Recommended