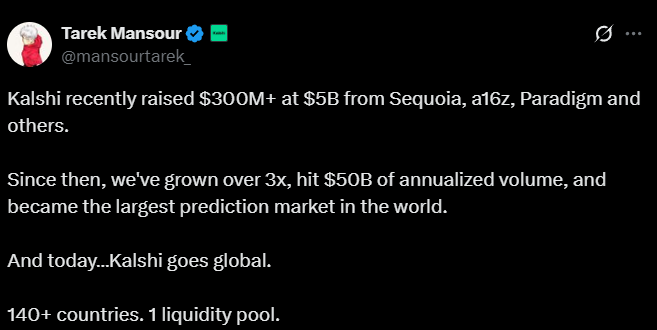

Kalshi Launches Global Expansion After Securing $300 Million in Funding

Prediction market platform Kalshi announced its expansion into over 140 countries this week. The move follows a funding round that raised over $300 million, boosting the company’s valuation to $5 billion. Kalshi’s global push positions it in direct competition with rival Polymarket on international markets.

Valuation Jumps Amid Market Share Gain

Kalshi, which launched exclusively in the U.S. in 2021, closed its substantial funding round in August. The $300 million raised more than doubled the company’s valuation from its previous estimate of $2 billion four months earlier.

The round was led by major venture-capital firms Sequoia Capital and Andreessen Horowitz (a16z). Other participants included returning investor Paradigm, CapitalG, General Catalyst, Spark Capital, and Coinbase Ventures. Celebrity investors, including comedian Kevin Hart and NBA star Kevin Durant, also joined the funding round. This massive capital injection signals strong investor confidence in the future of regulated prediction markets.

Despite its initial U.S. focus, Kalshi has seen rapid growth. Data from Dune shows Kalshi’s share of the global prediction market volume soared from just 3% a year ago to over 60% in September. The platform recorded a trading volume exceeding $1 billion in the week ending October 6.

Restricted Regions and Regulatory Challenges

While Kalshi touts its “global” reach, its updated user agreement reveals a restricted list of 45 regions. This list excludes significant portions of the English-speaking world, including Canada, the United Kingdom, and Australia.

The expansion places Kalshi on a collision course with rival Polymarket, which historically operated internationally using stablecoins. Polymarket recently received federal regulatory approval to relaunch in the U.S., intensifying the rivalry.

Kalshi faces the same regulatory risks that have affected its competitors abroad. For instance, comparable product Polymarket was previously blocked in Colombia, France, Switzerland, and Singapore due to regulatory issues.

Regulators may view Kalshi’s rapidly growing sports-related contracts as untaxed gambling, which could lead to legal hurdles similar to those Kalshi currently faces in the U.S. The company’s move abroad is largely driven by its sports-event offerings, but the regulatory environment for these products remains highly fragmented globally.

Recommended