Special Committee Clears PENN Board in HG Vora Dispute

A Special Litigation Committee (SLC) has officially vindicated the board of directors at PENN Entertainment regarding its aggressive defensive maneuvers against activist investor HG Vora. In a report filed on November 26, 2025, the committee determined that the board acted in “good faith” when it reduced the number of director seats earlier this year.

The “Business Judgment” Defense

The SLC, comprised of two independent lawyers, was tasked with reviewing the merits of the lawsuit filed by HG Vora in May 2025.

The investor had accused PENN of manipulating corporate machinery to block a specific board nominee. The committee’s report concludes that the board’s actions fell within the protection of the “business judgment” rule.

This legal doctrine generally presumes directors act in the best interest of the corporation unless proven otherwise.

According to the report, the board’s decision to shrink its size from nine members to eight was not a “scheme” to suppress shareholder rights.

Instead, the committee found the move was a necessary step to protect the company’s most critical assets: its gaming licenses.

The SLC has recommended that the court dismiss the derivative claims, stating that continuing the litigation is not in the company’s best interest.

The Rejected Candidate and Regulatory Risk

The conflict centered on HG Vora’s attempt to seat three directors, including former PENN CFO William Clifford. The board accepted two nominees but drew a hard line at Clifford.

The SLC report highlights the board’s view that Clifford was “unsuited” for the role, citing his “antiquated views” on the industry and a “closed mind.”

Beyond personality clashes, the board cited severe regulatory concerns regarding HG Vora’s ownership structure. The investor held an 18.5% economic interest in PENN but structured the holdings to keep direct ownership at only 4.8%. The remaining 13% was held in derivatives.

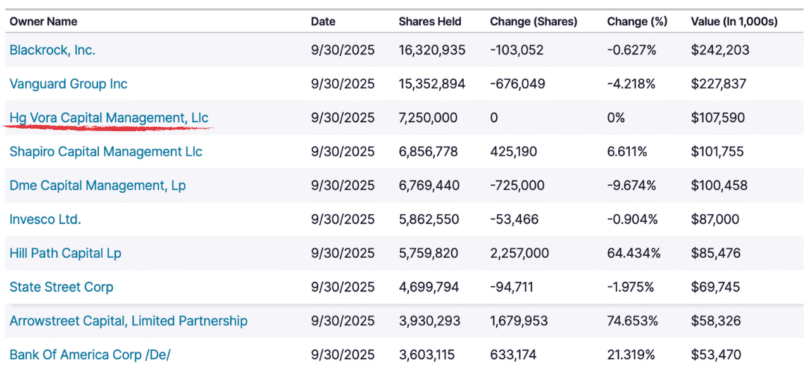

Source: Nasdaq.com

Source: Nasdaq.com

The board argued this structure was designed to bypass state licensing requirements triggered by 5% ownership. Regulators often view such attempts to influence operations without undergoing licensure as “improper.”

The SLC agreed that the board had a “real concern” that an unlicensed, potentially “Unsuitable Person” was exerting influence over the company. The reduction of the board seat was, therefore, a defensive measure to prevent regulatory fallout.

Origins of the Proxy War

The legal battle is the culmination of a long-running dispute over PENN’s performance. HG Vora began pressuring the company in late 2023, criticizing the board for “reckless spending” and “value-destructive deals.”

The activist pointed to an 81% decline in share price over four years and over $1 billion in losses from the company’s interactive segment.

This included the failed Barstool Sports partnership (sold back to its founder for $1) and the slow start of the ESPN BET integration.

HG Vora has rejected the SLC’s findings. The firm argues the investigation was biased and failed to address the core financial mismanagement that precipitated the proxy fight.

While the SLC report is a significant victory for PENN, the federal court must still accept the findings before the claims can be formally dismissed.

Recommended