Sportradar Q2 Revenue Soars 14% to Record €318M, Boosted by 30% US Growth

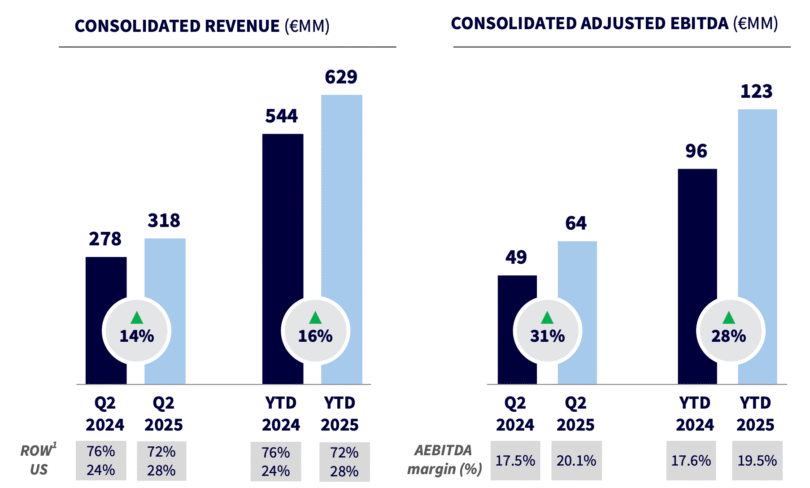

Sportradar has delivered a record-breaking second quarter, with revenue climbing 14% to an all-time high of €318 million. The sports data and technology giant also saw a jump in profitability, driven by strong growth in the U.S. market and disciplined cost management.

The US Market Becomes a Primary Growth Engine

The standout performer in the quarter was Sportradar’s U.S. division, which saw revenue climb by an impressive 30% year-over-year to €88 million.

The U.S. now accounts for 28% of the company’s total revenue, up from 24% in the same period last year, solidifying its position as a critical growth engine.

CEO Carsten Koerl highlighted the massive potential in the U.S. in-play betting market. He noted that while in-play currently accounts for about 50% of handle, the trend is moving toward the 70%+ levels seen in mature markets.

The financial implications of this shift are enormous. “1% conversion is accounting to EUR 6 million EBITDA for us, and that is more or less a direct flow-through,” Koerl stated, underscoring the massive opportunity ahead.

Profitability Soars on Operational Efficiency

Beyond the record top-line numbers, Sportradar demonstrated significant operational leverage. Adjusted EBITDA for the quarter jumped 31% to €64 million, with the adjusted EBITDA margin expanding by a robust 254 basis points to 20.1%.

This improved profitability was the direct result of disciplined cost control, with both sports rights expenses and personnel costs decreasing as a percentage of revenue.

The company’s bottom line also saw a dramatic improvement, swinging to a net profit of €49 million from a €2 million loss in Q2 2024.

This was further bolstered by strong cash generation, with €84 million in free cash flow in the first half of the year, a 41% increase from the prior year. The company ended the quarter with a strong liquidity position of €312 million in cash and no debt.

Innovation and Strategic Partnerships Drive Success

Sportradar’s strong quarter was underpinned by a series of key strategic wins and product innovations. The company deepened its partnership with Germany’s Bundesliga, rolling out new in-play betting products, and secured exclusive global betting rights for the FIFA Club World Cup, a major addition to its content portfolio.

The company is also seeing strong adoption of its new technology offerings. Its 4Sight Streaming product, which enhances the live viewing experience, drove a 30% increase in turnover for a key partner, Lottomatica’s GoldBet brand.

The expansion of its micro-market offerings for MLB and WNBA has also been met with rapid player adoption. Koerl also highlighted the impact of AI, noting that new tools have increased developer productivity by up to 40%, allowing for faster product launches.

A Confident Outlook and a Major Acquisition on the Horizon

The strong performance and sustained momentum have given Sportradar the confidence to raise its full-year guidance for 2025. The company now expects revenue to grow by at least 16% to a minimum of €1.278 billion, with adjusted EBITDA projected to grow by at least 28% to €284 million.

This upgraded forecast does not yet include the impact of the company’s pending acquisition of IMG ARENA’s sports betting rights portfolio.

The deal, which is expected to close in the fourth quarter, will be immediately accretive to revenue, EBITDA, and free cash flow. In a sign of its disciplined acquisition strategy, Sportradar confirmed it is not acquiring IMG’s unprofitable European league rights, focusing only on assets that meet its strict ROI criteria.

“Our industry leading scale, including our premium content and product portfolio and leading technology and AI, is driving customer uptake and above market growth,” said Koerl. “The inherent leverage in our business, combined with our focus on efficiencies, is driving sustainable margin expansion and cash flow generation.”

Recommended