US Gaming Revenue Hits Record $6.73B in May, Fueled by 27.5% Online Surge

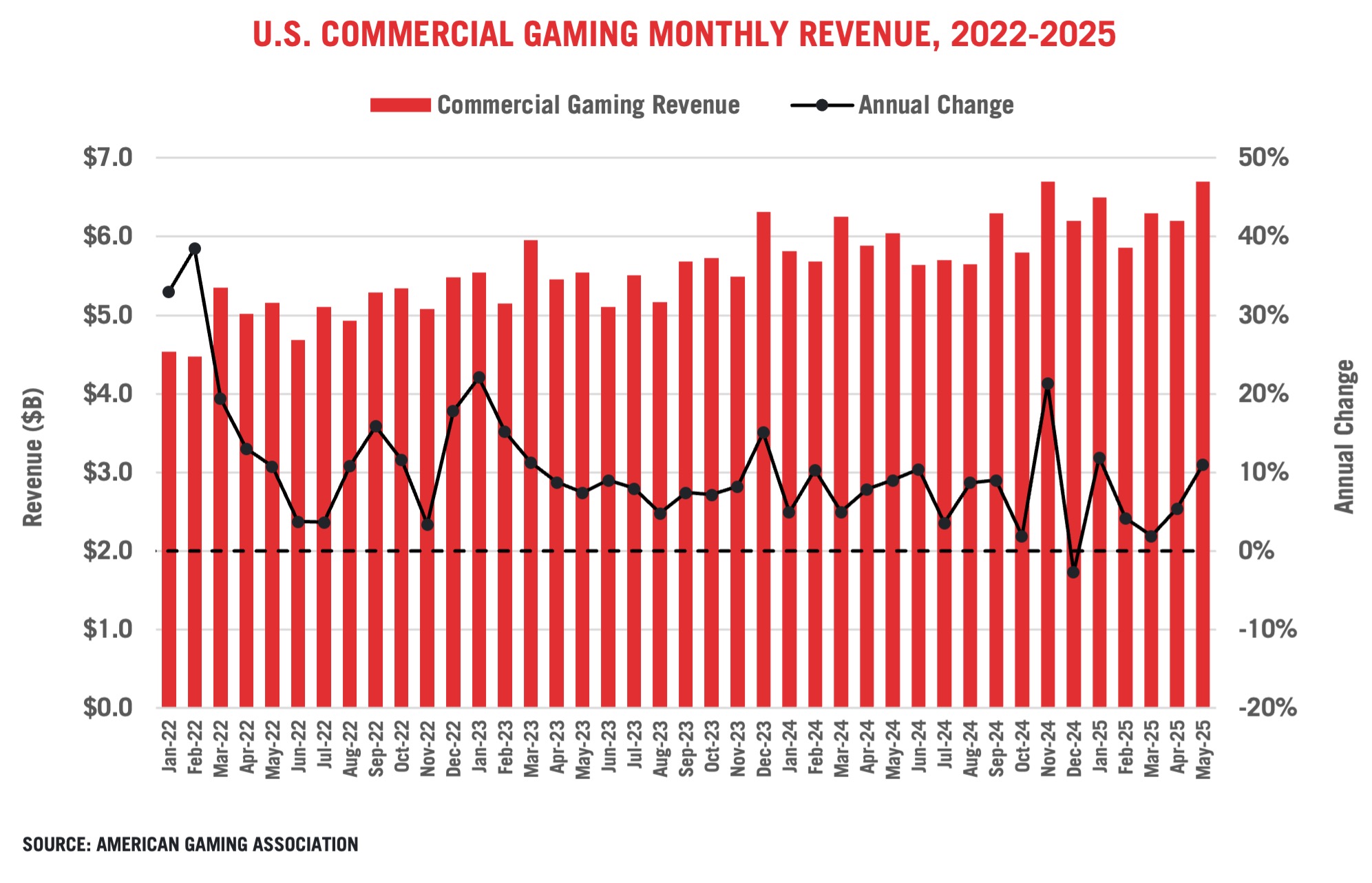

The U.S. commercial gaming industry posted a record-breaking performance in May, with total revenue reaching $6.73 billion. This 10.9% year-over-year increase was driven by explosive growth in the online gaming sector, according to the American Gaming Association’s (AGA) latest revenue tracker.

A Two-Speed Industry: Online Booms While Land-Based Grows Steadily

The May data highlights a clear trend in the US gaming market: a fast-growing digital sector paired with a stable, mature land-based industry.

The online gaming segment, which includes sports betting and iGaming, saw its revenue soar by 27.5% to $2.19 billion. In contrast, the land-based sector, comprising traditional casino games and retail sports betting, grew by a more modest but still healthy 4.8%, bringing in $4.53 billion.

This broad-based growth was felt across the country, with 35 of the 37 commercial gaming jurisdictions reporting year-over-year revenue increases. Only Nevada (-2.2%) and South Dakota (-3.1%) saw slight declines. Year-to-date, total commercial gaming revenue now stands at $31.89 billion, up 7.1% from the same period last year.

iGaming and Sports Betting Lead the Charge

The iGaming sector was particularly strong, surging 33% to a monthly revenue of $899.8 million. All seven states with legal iGaming posted annual revenue gains, with Delaware, Rhode Island, and West Virginia more than doubling their iGaming revenue compared to May 2024.

Online sports betting also posted impressive gains. Commercial sportsbook revenue climbed 24.3% to $1.37 billion for the month. Americans wagered $12.10 billion on sports, a 15.5% increase from the previous year.

The national hold rate was a strong 11.3%, indicating a profitable month for operators.

Brick-and-Mortar Casinos Remain the Foundation

While the online sector is growing faster, traditional brick-and-mortar casinos continue to be the industry’s backbone. Revenue from casino slots and table games hit $4.45 billion in May, a 3.9% increase from the prior year. Slot revenue grew 4.4% to $3.24 billion, while table game revenue was up 3.3% to $894.07 million.

Growth in the land-based sector was driven by both new and established markets. Recently expanded markets like Illinois (+22.7%), Virginia (+36.1%), and Nebraska (+149.8%) saw massive gains.

However, mature markets also performed well, with strong growth in West Virginia (+24.4%), New Jersey (+10.9%), and Maine (+10.4%).

The AGA’s May report paints a picture of a healthy and expanding US gaming industry. The continued surge in online verticals is creating new revenue streams and driving overall market growth, while the traditional land-based sector provides a stable and profitable foundation.

The data confirms that the industry’s expansion is not slowing down. As more states consider legalizing iGaming and with sports betting still growing in many jurisdictions, the trend of strong year-over-year growth is likely to continue through the remainder of 2025.

Recommended